Trolley Payouts: Enterprise-Ready Global Mass Payment Solution

Introduction

Modern digital platforms operate across borders, currencies, and regulatory environments. As businesses scale, managing payments to global partners becomes increasingly complex. Manual banking workflows often create operational bottlenecks, compliance risks, and reconciliation challenges.

Trolley payouts provide structured infrastructure that helps automate international mass payment distribution while maintaining transparency and regulatory alignment. This guide explores how the system works, who uses it, and why structured payout automation matters for growth-focused companies.

About Trolley

Trolley is a financial technology provider focused on mass payment automation. The platform integrates payment execution, recipient onboarding, tax form collection, and reporting into a centralized dashboard.

Instead of relying on fragmented banking tools, organizations use trolley payouts to streamline large-scale payment operations.

How Trolley Payouts Infrastructure Works

4

1. Secure Recipient Onboarding

Payees are invited to submit required information via a protected portal, including:

- Bank or payout account details

- Tax documentation

- Identity verification information

This reduces errors and standardizes documentation across international recipients.

2. Automated Payment Distribution

Trolley payouts support:

- Domestic bank transfers

- Cross-border payments

- Multi-currency disbursements

- Batch payout execution

High-volume processing ensures scalability without increasing manual workload.

3. Compliance & Tax Documentation

Built-in tools assist with:

- Tax form collection

- Validation workflows

- Record retention

- Reporting preparation

These systems help businesses meet documentation standards across different jurisdictions.

4. Financial Reporting & Reconciliation

Finance teams benefit from:

- Real-time payment status tracking

- Downloadable transaction reports

- Integration with accounting platforms

- Audit trail visibility

Centralized reporting improves operational transparency.

Core Capabilities of Trolley Payouts

Global Coverage

Trolley payouts are designed to operate internationally, supporting payments across numerous countries and currencies.

API-Driven Architecture

Developers can embed payout functionality directly into their applications, marketplaces, or internal dashboards.

Multi-Currency Management

The platform allows businesses to manage payouts across different currencies, simplifying international settlements.

Enterprise Security Standards

Security protocols typically include encrypted data transmission, structured access permissions, and detailed audit logs.

Business Use Cases

4

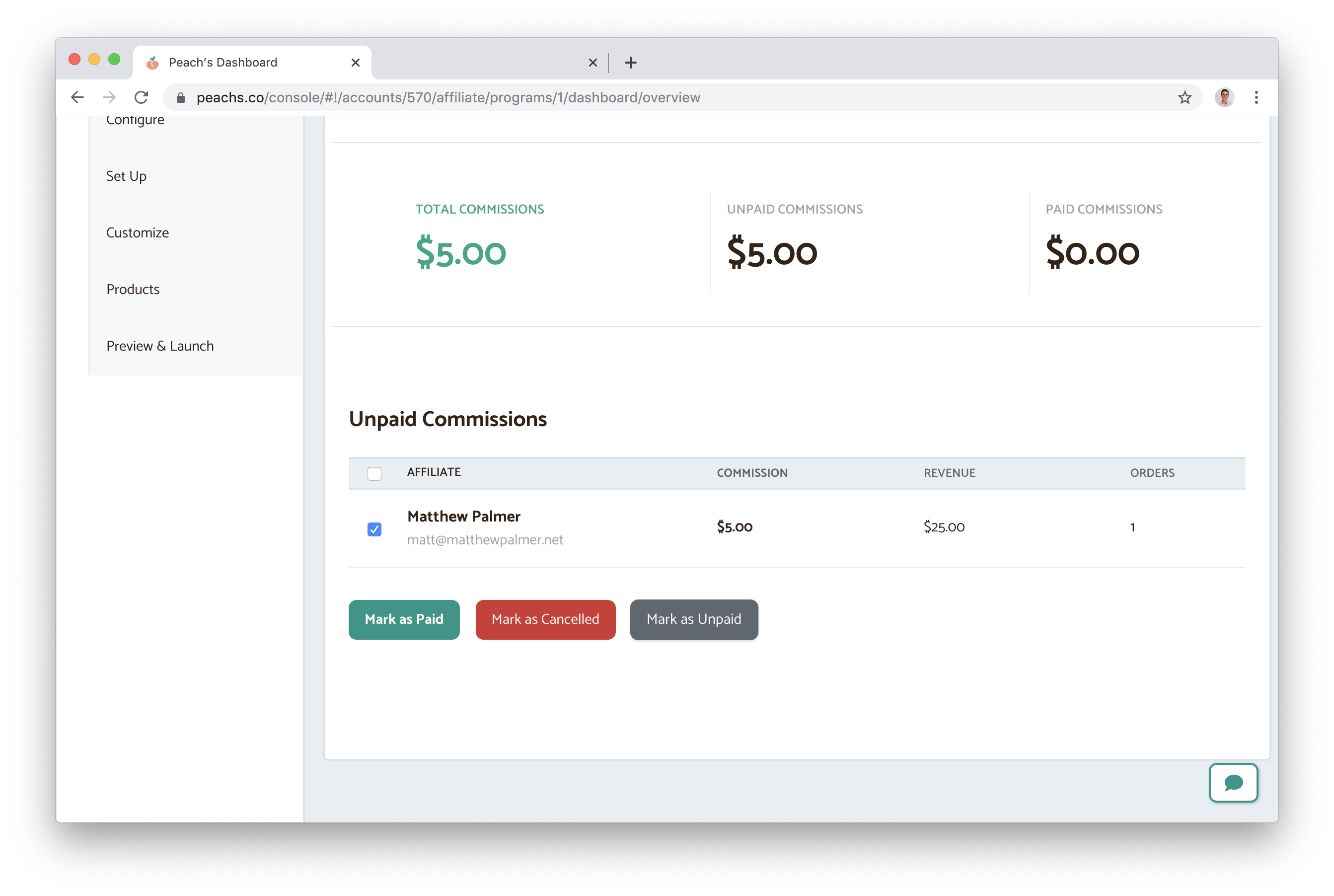

Trolley payouts are commonly implemented by:

- Affiliate networks distributing commissions

- Creator platforms paying contributors

- Marketplaces handling vendor settlements

- SaaS companies managing partner programs

- Gig economy platforms compensating contractors

Any organization distributing recurring or high-volume payments can leverage payout automation.

Strategic Advantages

Operational Efficiency

Automation minimizes repetitive manual processes, reducing human error and administrative burden.

Scalable Infrastructure

As transaction volume grows, trolley payouts can handle increasing demand without restructuring financial operations.

Compliance Confidence

Automated documentation workflows support structured regulatory alignment.

Improved Financial Oversight

Centralized dashboards provide visibility into payout cycles, conversion details, and transaction histories.

Implementation Considerations

Before deploying trolley payouts, organizations typically evaluate:

- Integration requirements

- Payment volume expectations

- Geographic payout distribution

- Tax documentation obligations

- Internal accounting workflows

A phased integration approach often supports smoother adoption.

Frequently Asked Questions

What are trolley payouts?

Trolley payouts refer to automated global mass payment services provided by Trolley, enabling organizations to distribute funds securely and efficiently.

Are trolley payouts suitable for international businesses?

Yes, the platform is designed to support cross-border disbursements and multi-currency payments.

Can trolley payouts integrate with internal systems?

API connectivity allows integration with marketplace platforms, SaaS dashboards, and accounting tools.

Does trolley payouts assist with tax documentation?

The platform includes workflows to collect and manage required tax forms.

Conclusion

Trolley payouts provide enterprise-ready infrastructure for automating global mass payment distribution. By combining compliance tools, multi-currency support, and reporting transparency, the platform reduces operational friction and supports scalable growth.

For organizations expanding internationally, implementing structured payout automation can enhance efficiency, oversight, and payment reliability.