Trolley Payouts: Complete Guide to Global Mass Payment Infrastructure

Introduction

Managing global contractor, affiliate, and marketplace payments can quickly become complex. Currency conversions, tax documentation, compliance requirements, and multi-country banking rules create operational pressure for growing companies.

Trolley payouts offer a structured infrastructure designed to simplify mass payment distribution while maintaining regulatory compliance and transparency. This guide explains how trolley payouts work, what features businesses rely on, and how the platform supports scalable international payment operations.

What Is Trolley?

Trolley is a fintech platform that provides automated mass payment solutions for marketplaces, creator platforms, SaaS companies, and enterprise organizations. The system focuses on three core pillars:

- Global payouts

- Tax and compliance automation

- Payment reconciliation and reporting

The goal of trolley payouts is to reduce manual administrative work while improving payment speed and accuracy.

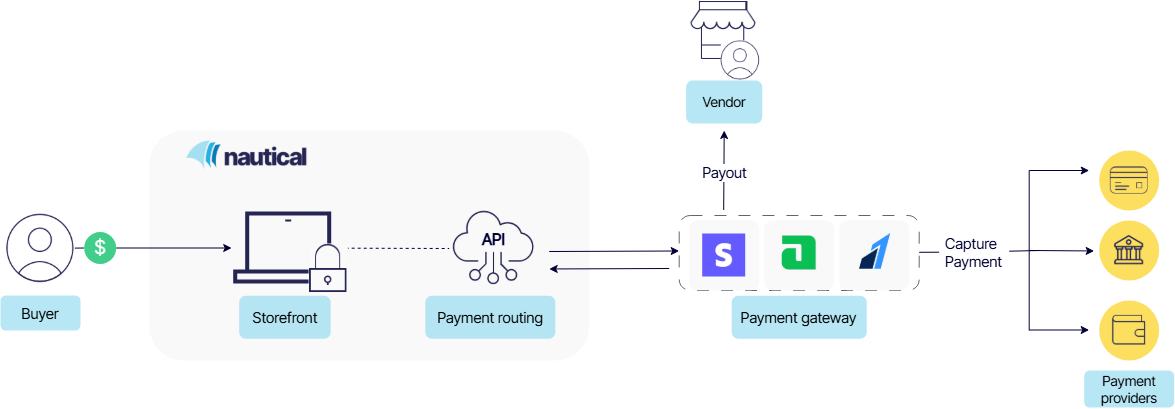

How Trolley Payouts Work

4

At a high level, trolley payouts follow this workflow:

1. Recipient Onboarding

Businesses invite payees (contractors, creators, partners) to securely submit:

- Payment details

- Tax forms

- Identity verification data

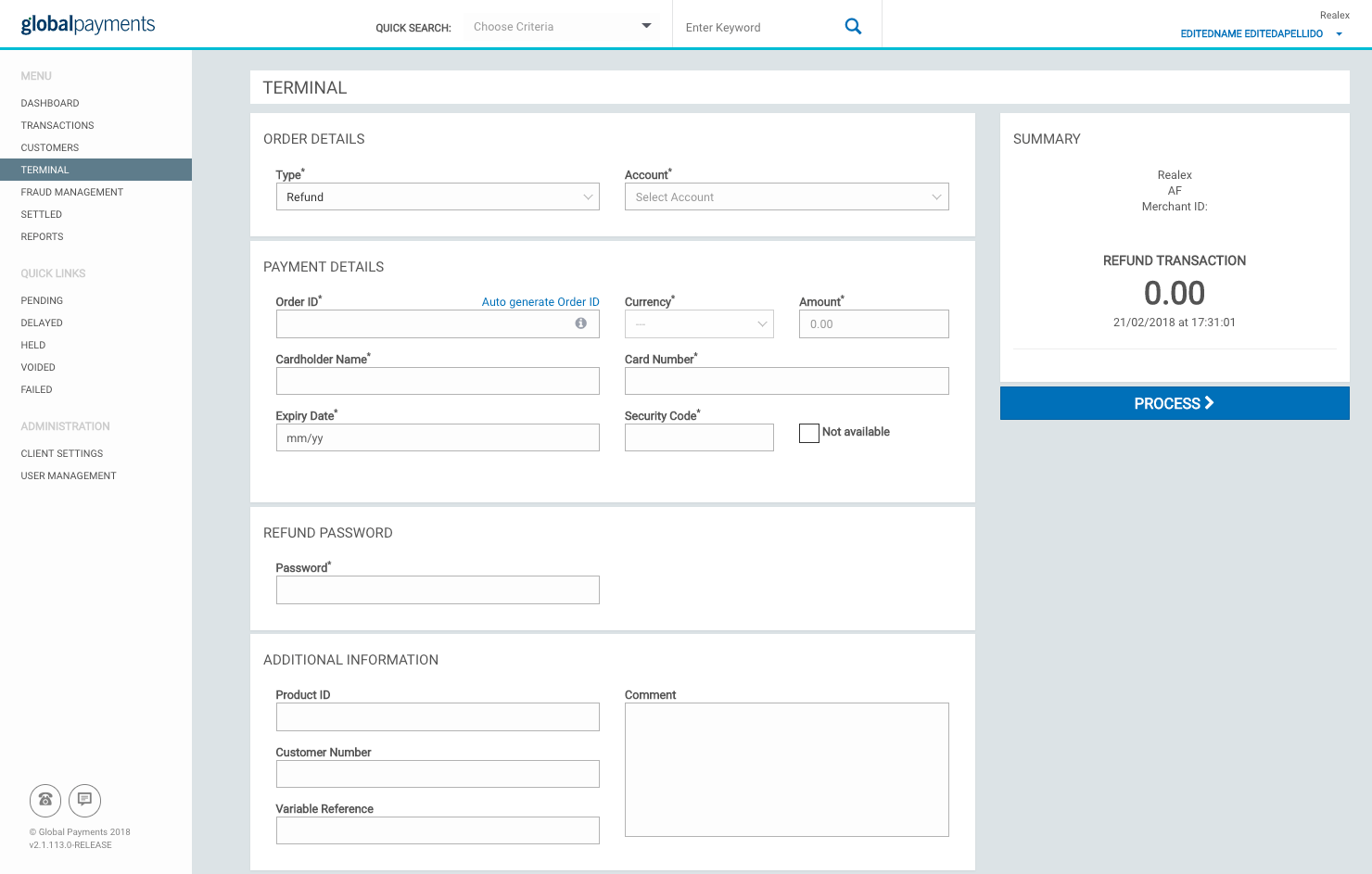

2. Payment Processing

The platform supports multiple payout methods:

- Local bank transfers

- International wire transfers

- Digital wallet options

- Multi-currency disbursements

3. Compliance & Tax Handling

Automated tax form collection (such as W-8/W-9 equivalents) and reporting tools reduce compliance risk.

4. Reconciliation & Reporting

Finance teams can track payment statuses, export transaction logs, and integrate with accounting systems.

Key Features of Trolley Payouts

Global Reach

Trolley supports payouts to recipients in over 200 countries and territories, making it suitable for international marketplaces and digital platforms.

Multi-Currency Capabilities

Businesses can hold, convert, and distribute funds in multiple currencies, reducing FX friction.

Built-In Compliance Tools

Automated tax documentation collection and validation workflows help maintain regulatory alignment across jurisdictions.

API & Integration

Trolley offers API-based integration that enables businesses to embed payout functionality directly into their own platforms.

Data Security

Security protocols include encrypted data transmission and strict access controls.

Who Uses Trolley Payouts?

4

Trolley payouts are commonly used by:

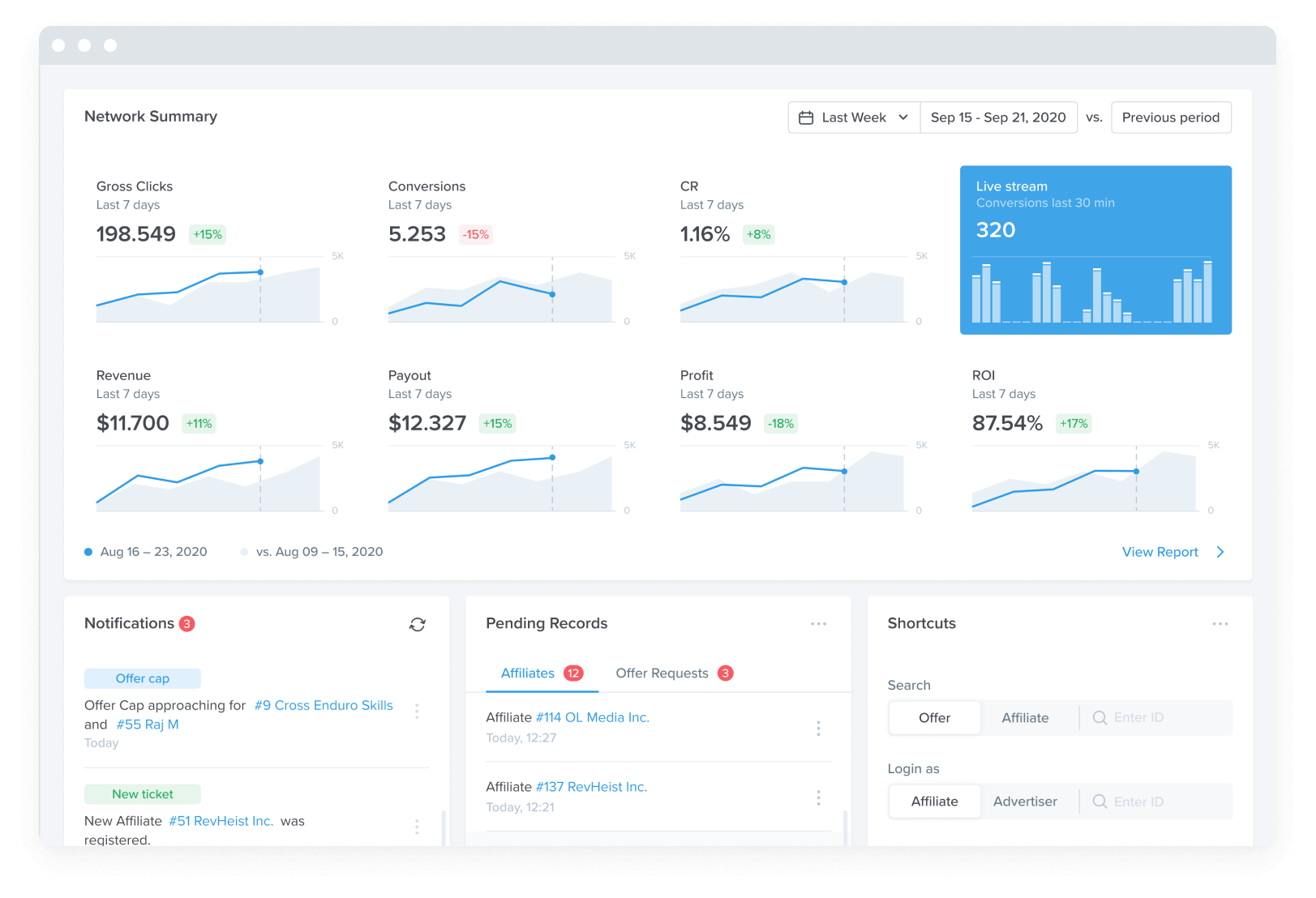

- Affiliate networks

- Creator platforms

- Online marketplaces

- SaaS companies with partner programs

- Gig economy platforms

Any business that distributes funds at scale can benefit from structured payout automation.

Benefits of Implementing Trolley Payouts

1. Reduced Manual Work

Automation decreases administrative overhead for finance teams.

2. Faster Payment Cycles

Streamlined approval and processing pipelines improve payout timelines.

3. Lower Compliance Risk

Automated tax collection reduces documentation gaps.

4. Scalable Infrastructure

The platform supports high-volume payment runs without operational strain.

Trolley Payouts vs. Traditional Bank Transfers

| Feature | Trolley Payouts | Traditional Banking |

|---|---|---|

| Global Coverage | Extensive | Often limited |

| Automation | API-driven | Mostly manual |

| Tax Handling | Integrated tools | External processing |

| Reporting | Real-time dashboards | Manual reconciliation |

| Multi-Currency | Native support | FX fees and delays |

Security & Regulatory Considerations

When evaluating trolley payouts, businesses typically assess:

- Data encryption standards

- Compliance certifications

- Audit logs

- Role-based access controls

- Payment traceability

Modern payout platforms prioritize transparency and risk management to meet enterprise standards.

Is Trolley Payouts Right for Your Business?

Trolley payouts are generally suitable if your organization:

- Pays contractors or partners internationally

- Requires automated tax documentation

- Needs scalable disbursement workflows

- Operates across multiple currencies

For smaller domestic-only operations, simpler payment methods may be sufficient. However, as cross-border complexity increases, structured payout infrastructure becomes more valuable.

Frequently Asked Questions

What are trolley payouts?

Trolley payouts refer to automated global mass payment solutions provided by Trolley, enabling businesses to distribute funds securely across multiple countries.

Does Trolley support international payments?

Yes, trolley payouts support cross-border disbursements in numerous currencies worldwide.

Can trolley payouts integrate with internal systems?

The platform offers API integration to connect with accounting and marketplace platforms.

Is tax documentation handled within trolley payouts?

Yes, tax form collection and reporting tools are part of the system’s compliance infrastructure.

Final Thoughts

Trolley payouts provide a structured solution for businesses managing high-volume, cross-border payment operations. With integrated compliance tools, multi-currency support, and automation features, the platform reduces operational complexity while improving scalability.

For companies operating globally, implementing a unified payout infrastructure like trolley payouts can significantly enhance efficiency and payment reliability.