Trolley Payouts 2026 Guide: Architecture, Compliance & Global Payment Scaling

Introduction

As platforms expand internationally, payout complexity increases exponentially. Companies must manage:

- Cross-border regulations

- Currency conversion

- Tax documentation

- Fraud prevention

- Real-time reporting

Trolley payouts are designed to consolidate these processes into a structured global payment infrastructure. Instead of fragmented banking workflows, organizations can centralize onboarding, compliance, and disbursement under one system.

About Trolley

Trolley focuses on mass payment automation for digital businesses. Its platform supports marketplaces, SaaS companies, creator networks, and global contractor ecosystems.

The system integrates:

- Recipient onboarding

- Payment execution

- Tax form collection

- Regulatory documentation workflows

- Financial reporting dashboards

This unified model reduces operational silos.

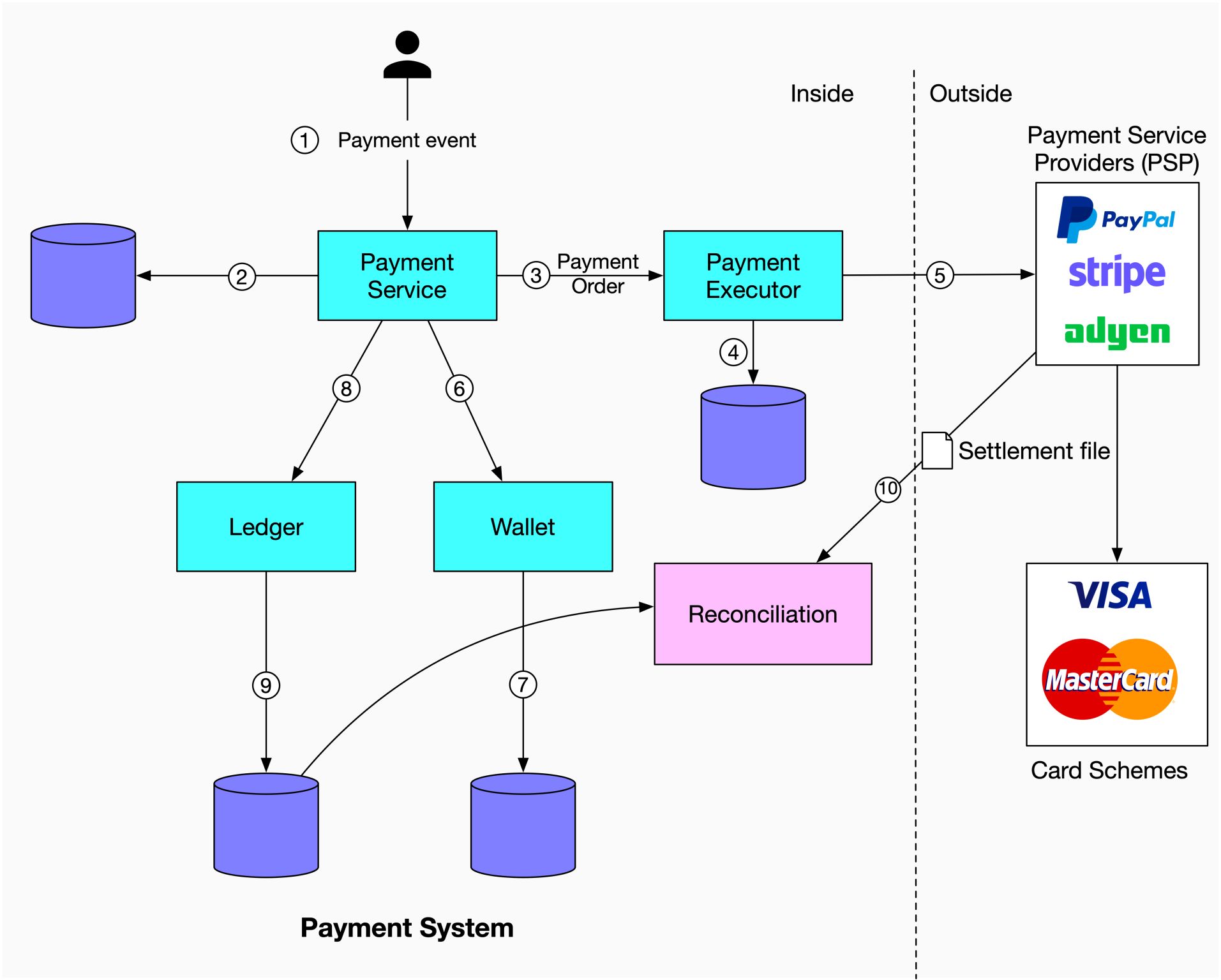

Trolley Payouts System Architecture

4

1. Secure Onboarding Layer

Recipients access a protected portal to:

- Submit payout details

- Upload tax documentation

- Verify identity credentials

Automated validation minimizes manual review.

2. Payment Orchestration Engine

The core payout engine supports:

- Local ACH-style transfers

- International wire equivalents

- Multi-currency settlements

- Batch disbursement execution

This orchestration layer ensures scalability across thousands of transactions.

3. Compliance Automation

Trolley payouts include structured workflows for:

- Tax form collection

- Documentation validation

- Record retention

- Reporting assistance

Automation reduces compliance risk while maintaining audit readiness.

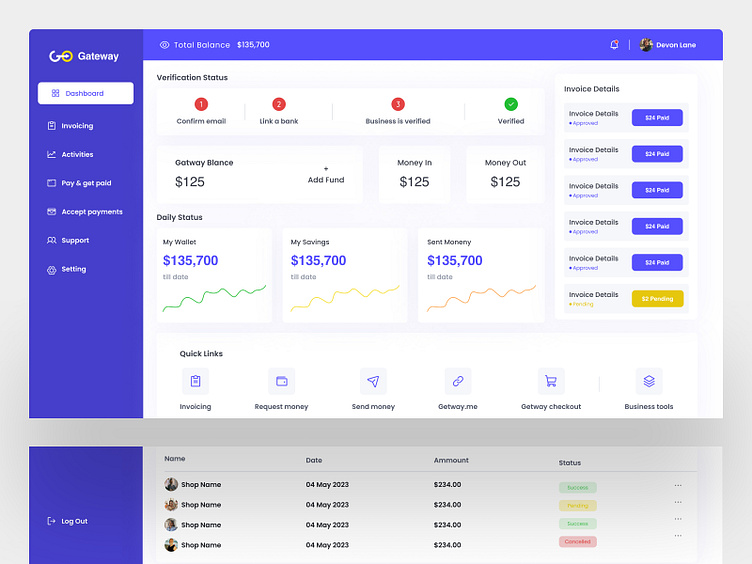

4. Reporting & Audit Layer

Finance teams gain access to:

- Real-time payout tracking

- Conversion summaries

- Transaction logs

- Exportable reconciliation reports

Visibility is critical for enterprise environments.

Advanced Features of Trolley Payouts

API-First Design

Developers can embed payout functionality directly into platforms, enabling seamless user experiences.

Multi-Currency Infrastructure

Businesses can distribute funds in multiple currencies, reducing friction in global contractor networks.

Scalable Batch Processing

Bulk payment runs can handle high transaction volumes without operational bottlenecks.

Security Controls

Common security measures include:

- Encrypted data transmission

- Role-based access permissions

- Transaction audit trails

- Activity monitoring

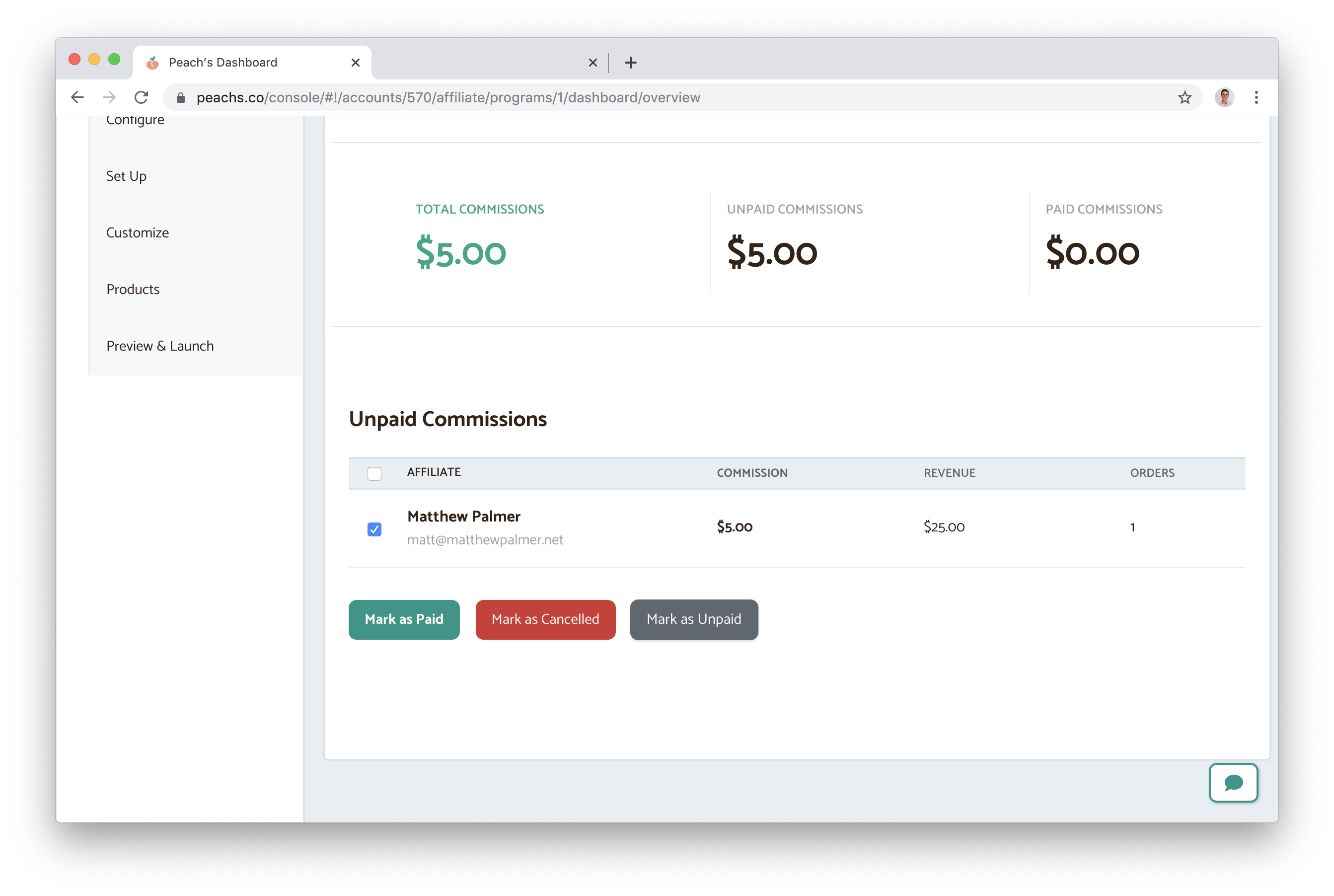

Industry Applications

4

Trolley payouts are frequently used in:

- Affiliate marketing networks

- Creator monetization platforms

- E-commerce marketplaces

- SaaS partner ecosystems

- Gig-based contractor platforms

Any organization distributing performance-based or recurring payments at scale can benefit from structured automation.

Business Impact of Trolley Payouts

1. Reduced Operational Overhead

Automation replaces spreadsheets, manual transfers, and fragmented compliance workflows.

2. Faster Payment Cycles

Centralized processing improves turnaround times for global recipients.

3. Improved Compliance Alignment

Structured documentation workflows support regulatory standards across jurisdictions.

4. Enhanced Financial Transparency

Dashboards provide centralized visibility into payout status and historical data.

Trolley Payouts vs Fragmented Payment Systems

| Capability | Trolley Payouts | Fragmented Setup |

|---|---|---|

| Global Coverage | Unified | Multiple vendors |

| Compliance Automation | Integrated | Manual |

| Multi-Currency | Native | External FX |

| Reporting | Centralized | Disconnected |

| API Access | Available | Limited |

Fragmented systems often increase administrative risk and slow scaling efforts.

Implementation Roadmap

Organizations typically approach deployment in phases:

- Evaluate payout volume and geographic distribution

- Map compliance requirements

- Integrate API endpoints

- Conduct internal testing

- Launch structured payout cycles

A phased approach supports smoother operational adoption.

Frequently Asked Questions

What are trolley payouts?

Trolley payouts refer to automated global mass payment solutions provided by Trolley for businesses distributing funds internationally.

Are trolley payouts scalable?

Yes, the infrastructure supports high-volume batch processing for growing organizations.

Does trolley payouts handle cross-border payments?

The platform is designed for global disbursement with multi-currency capabilities.

Can trolley payouts integrate with enterprise systems?

API connectivity allows integration with accounting platforms, marketplaces, and SaaS systems.

Conclusion

Trolley payouts provide enterprise-grade infrastructure for automating global payment distribution. By combining onboarding, compliance, and multi-currency disbursement into a centralized system, organizations can reduce operational friction and scale internationally with greater confidence.

For platforms operating in the global digital economy, structured payout automation supports efficiency, transparency, and long-term operational resilience.