Trolley Payouts Platform Review: Global Disbursement, Compliance & Automation

Introduction

International payment distribution requires more than simple transfers. Companies operating across multiple regions must coordinate compliance documentation, tax forms, currency conversion, and financial reporting — all while maintaining payout accuracy and speed.

Trolley payouts are designed to address these operational challenges through structured automation. This review examines how the platform supports global disbursement workflows and scalable financial operations.

Company Overview: Trolley

Trolley is a financial technology provider focused on automating mass payment infrastructure. The platform is widely adopted by digital marketplaces, SaaS ecosystems, affiliate networks, and creator-based platforms.

Trolley payouts consolidate multiple operational layers:

- Payee onboarding

- Payment execution

- Multi-currency support

- Tax documentation collection

- Reporting & reconciliation

This unified model reduces reliance on fragmented banking workflows.

How Trolley Payouts Operate

4

1. Digital Payee Onboarding

Recipients are invited to a secure portal where they submit:

- Bank or payout account details

- Required tax documentation

- Identity verification information

Automated validation workflows reduce manual review time.

2. Global Payment Distribution

Trolley payouts support:

- Domestic bank transfers

- Cross-border settlements

- Multi-currency disbursements

- Scheduled and batch payment runs

This allows companies to process large transaction volumes efficiently.

3. Compliance & Tax Management

The platform includes structured workflows for:

- Tax form collection

- Documentation validation

- Record retention

- Reporting support

These features help organizations maintain compliance across jurisdictions.

4. Monitoring & Reporting

Finance teams can access:

- Real-time payout tracking

- Currency conversion summaries

- Transaction logs

- Exportable financial reports

Centralized visibility supports operational transparency.

Key Strengths of Trolley Payouts

Scalable Payment Infrastructure

High-volume batch processing enables growth without proportional administrative expansion.

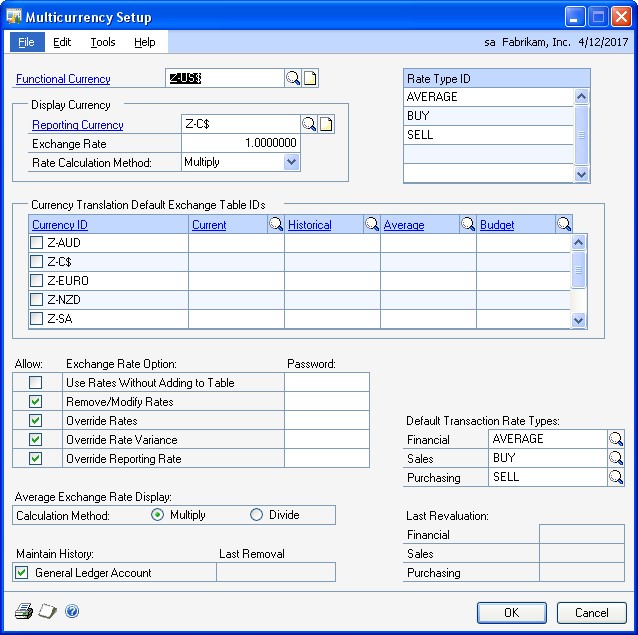

Multi-Currency Capabilities

Businesses can distribute funds globally with built-in currency management.

API Integration

Developers can embed payout functionality directly into platforms, enhancing user experience.

Enterprise Security

Security measures typically include encrypted communication, structured access controls, and detailed audit logs.

Typical Industry Use Cases

4

Trolley payouts are commonly implemented in:

- Affiliate marketing networks

- Creator monetization platforms

- Digital marketplaces

- SaaS partner programs

- Global contractor ecosystems

Organizations distributing recurring or performance-based payments often benefit most.

Pros & Considerations

Advantages

- Centralized payout management

- Compliance workflow automation

- Multi-currency support

- API-driven scalability

- Real-time reporting dashboards

Considerations

- Integration planning may require technical resources

- Best suited for medium to high payout volumes

- Organizations should evaluate internal compliance needs before deployment

Trolley Payouts vs Traditional Bank-Based Workflows

| Feature | Trolley Payouts | Traditional Workflow |

|---|---|---|

| Bulk Payment Automation | Yes | Manual |

| Multi-Currency Support | Native | External FX |

| Tax Documentation | Integrated | Separate |

| API Access | Available | Rare |

| Reporting | Centralized | Fragmented |

Manual processes often rely on spreadsheets and multiple vendors, increasing operational complexity.

Frequently Asked Questions

What are trolley payouts?

Trolley payouts refer to automated global mass payment services provided by Trolley.

Can trolley payouts support international disbursements?

Yes, the platform supports cross-border payments with multi-currency capabilities.

Is trolley payouts suitable for marketplaces?

Digital marketplaces frequently use payout automation to streamline vendor settlements.

Does trolley payouts include compliance workflows?

Yes, tax form collection and documentation validation tools are integrated into the platform.

Final Evaluation

Trolley payouts offer structured infrastructure for managing global mass disbursement operations. By combining automation, compliance management, and multi-currency support, the platform simplifies complex payout workflows.

For organizations operating internationally, centralized payout automation can improve efficiency, oversight, and long-term scalability.