Trolley Payouts Overview: Global Mass Payment Automation for Digital Platforms

Introduction

Scaling an online business often means managing payments across borders. Whether distributing funds to affiliates, creators, vendors, or contractors, companies must ensure accuracy, compliance, and speed.

Trolley payouts represent a structured solution for handling international mass payments through automated workflows. This article provides a comprehensive look at the platform’s capabilities, operational benefits, and strategic value for growing organizations.

About Trolley

Trolley is a fintech infrastructure provider specializing in global payout automation. The platform combines payment execution, tax documentation management, and compliance support into a unified environment.

Instead of managing separate banking relationships or manual transfer processes, businesses can centralize disbursement operations within one structured system.

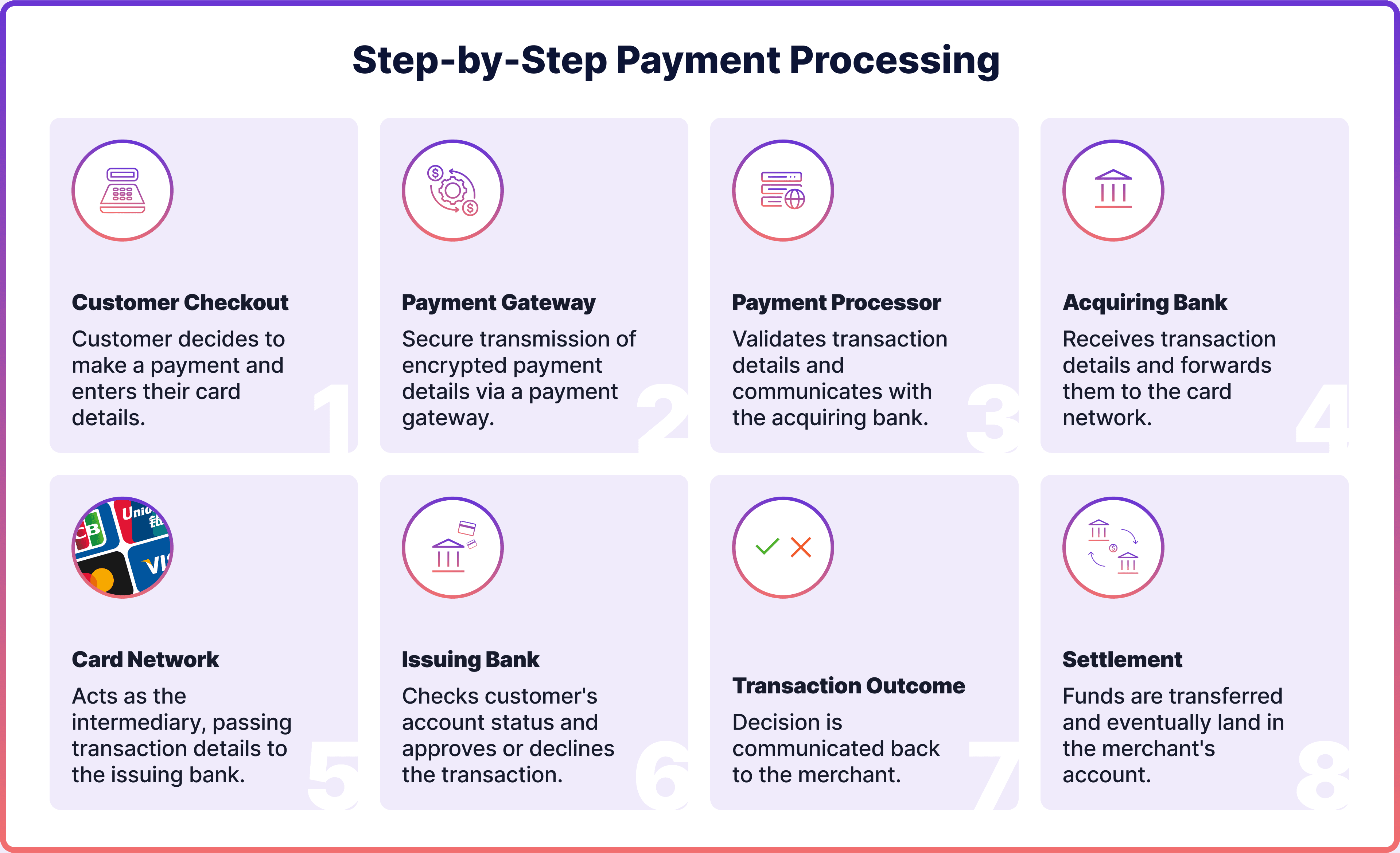

How Trolley Payouts Operate

4

Recipient Enrollment

Businesses invite recipients to a secure onboarding portal where they can:

- Enter bank or payout details

- Submit required tax forms

- Confirm identity information

This digital onboarding process reduces administrative errors and speeds up approval cycles.

Payment Distribution

Trolley payouts support a range of disbursement options, including:

- Local bank transfers

- International payments

- Multi-currency settlements

- Alternative digital payout methods

Bulk payment functionality enables organizations to process high volumes efficiently.

Compliance & Documentation

Integrated tax workflows help organizations:

- Collect required forms

- Validate documentation

- Maintain reporting consistency

These features support compliance across multiple jurisdictions.

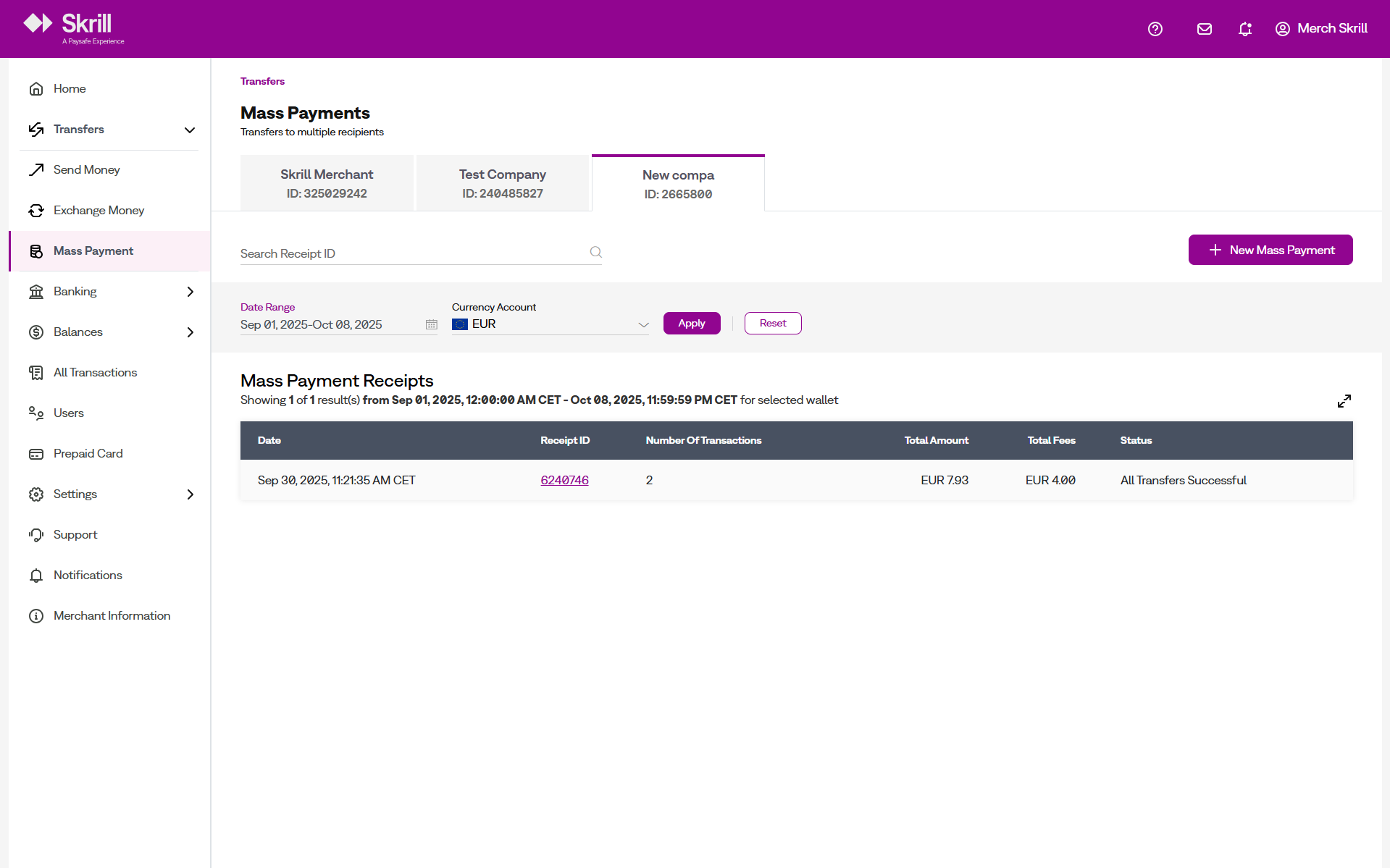

Reporting & Transparency

Finance teams can monitor:

- Payment status in real time

- Currency conversion records

- Historical payout logs

- Exportable financial summaries

Integration with accounting systems further streamlines reconciliation.

Key Capabilities of Trolley Payouts

1. Global Payment Reach

Trolley payouts are designed for businesses operating internationally, offering broad geographic coverage.

2. Multi-Currency Support

Built-in currency management reduces friction when distributing funds to recipients in different regions.

3. API Integration

Developers can embed payout functionality directly into marketplace platforms or SaaS environments through API access.

4. Security Framework

Security measures typically include encrypted communication, structured access controls, and transaction audit trails.

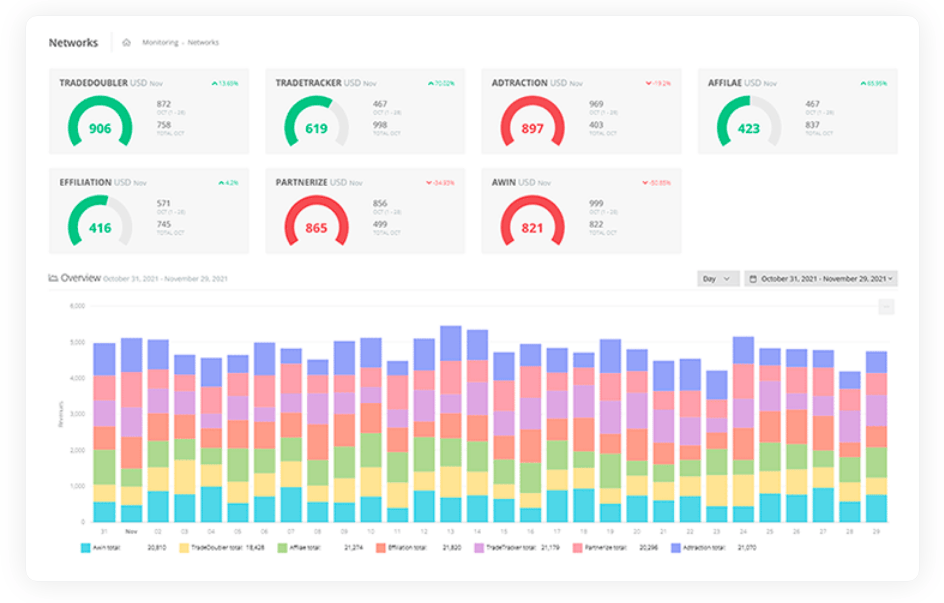

Practical Use Cases

4

Trolley payouts are commonly utilized by:

- Affiliate marketing networks

- Creator monetization platforms

- Digital marketplaces

- Software partner ecosystems

- Global contractor networks

Any organization distributing funds at scale may benefit from centralized payout automation.

Strategic Benefits

Operational Efficiency

Automation reduces manual intervention, freeing finance teams to focus on strategic tasks.

Scalability

As payout volumes increase, automated infrastructure handles growth without proportional increases in administrative workload.

Compliance Management

Integrated documentation workflows help maintain regulatory alignment.

Financial Visibility

Real-time dashboards improve oversight and decision-making.